City Expects Revenue Drop in FY16

Tuesday, January 13 2015

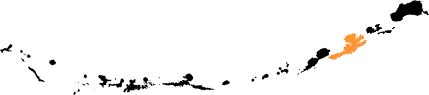

The city of Unalaska could see its first big drop in revenue since 2010 next fiscal year, as prices fall for resources the city depends on.

Finance director Patricia Soule will present her revenue projections to city council tonight.

In a memo, Soule writes that the city can expect to collect less tax on fuel sales. Oil prices have plummeted across the country. And since Unalaska’s port is open year-round, regular fuel shipments are still coming in -- following national price trends.

Seafood markets are also expected to be weak in the year ahead. Lower prices for cod, crab and pollock could result in nine percent less tax revenue for the city.

In all, Unalaska’s projected to bring in $34 million over the next fiscal year. City manager Chris Hladick says that’s a conservative figure. Hladick says a low estimate should help offset a potential drop in state funding for education and employee pensions.

The only local revenue stream that is holding strong is property taxes. They’re expected to bring in an additional $6 million in the upcoming fiscal year compared to 2015.

Besides land and buildings, Unalaska collects tax on the value of appliances and equipment inside local businesses -- including rental homes.

During recent public meetings on housing, landlords have complained that the tax is an unnecessary burden. The city designed tried to design an exemption for property owners with less than $30,000 worth of taxable items. In a memo to council, clerk Cat Hazen says it would apply to a group of more than 250 people -- but it would result in just about $7,000 less in revenue for the city.

The state assessor has approved the exemption, according to Hazen. Council will take a first look at the proposal tonight.

They meet at 6 p.m. at City Hall.

CLARIFICATION: City Clerk Cat Hazen says she got state approval for a $30,000 tax exemption. However, she says she misinterpreted who the exemption would cover. In fact, she says it has to apply to everyone who pays the tax, not just one group -- meaning the city would lose about $36,000 in tax revenue on the exemption, not $7,000. Hazen clarified this point at that night's council meeting.