Industry Groups Throw Weight Behind Oil Tax

Friday, August 15 2014

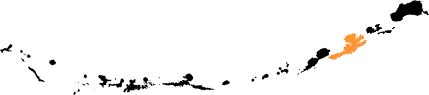

Knik Construction has posted similar "'No' on One" campaign signs at worksites around the Southwest. (Annie Ropeik/KUCB)

In just a few days, Alaskan voters will decide whether to repeal the state’s oil tax system. It’s question one on Tuesday’s primary ballot.

Unalaskans will see plenty of familiar names among the groups that want to keep the current policy, which tries to spur development by cutting taxes for oil producers.

The list includes Knik Construction, which has been paving Unalaska’s roads this summer. They’ve got “Vote ‘No’ on One” signs up on their asphalt plant in Unalaska and at project sites all over the Southwest. And their parent company, Anchorage-based Lynden Construction, has given almost $84,000 to the well-funded “Vote ‘No’” campaign, according to state records.

Dan Hall is Knik’s vice president. He says they think the current tax will keep the oil industry healthier for longer -- which means more state money for local projects, like Knik’s paving in Unalaska. He says Knik hasn’t seen more work crop up under the current tax, but they haven’t seen less, either.

"It’s either a long-term view or a short-term view, and short-term is never good in any business relationship," Hall says. "And the oil companies -- they’re our partners. That’s why you’re seeing a lot of support from industry folks."

In Unalaska, those supporters include NC Machinery and Samson Tug and Barge, plus the parent companies of local fuel suppliers, and unions that represent city employees. Those groups have all signed on to the “Vote ‘No’ on One” coalition -- as has the Resource Development Council, a statewide business association that Unalaska is part of. The city itself hasn’t taken an official position on the oil tax repeal.

Gunnar Knapp is the director of the Institute of Social and Economic Research at the University of Alaska Anchorage. He points out that Unalaska’s been a staging area for oil exploration in the past -- so boosting oil production could create more business here.

"People in the support services seem to think that they’re going to end up with more activity with a vote ‘no,’ or keeping the current tax system," Knapp says.

But when it comes to a more general reliance on state funds, Knapp says Unalaska’s a little different than other towns:

"Unalaska is one of relatively few communities in the state that derives very significant revenues from non-oil natural resources," he says.

He’s talking about the region’s fisheries. They bring in millions in city taxes every year, and supplement state funding when it’s low.

"That said, every community in Alaska remains very heavily dependent on oil revenues," Knapp says. "You can just start with the Permanent Fund Dividend income coming into your community, and then you think of all the support for your schools, and all the fisheries management stuff."

And both sides of the repeal debate say their tax will do the most for those revenues. But Knapp says oil production is so hard to forecast that it’s basically impossible to gauge the impact on communities in the short term.

"The fact is, neither side has the evidence, at this point, to show that they’re right and the other side is wrong," he says. "In other words, you can’t prove that the new tax is working; you can’t prove that it’s not working."

Either way, that’s what Unalaskans will have to decide week. The primary election is Tuesday, Aug. 19. The Republican primary for U.S. Senate and the Democratic primary for Lieutenant Governor will also be on that ballot.

Related: Oil Tax Reformers Face Uphill Battle in Unalaska (June 9, 2014)